Manage Taxes & Fees

Summary

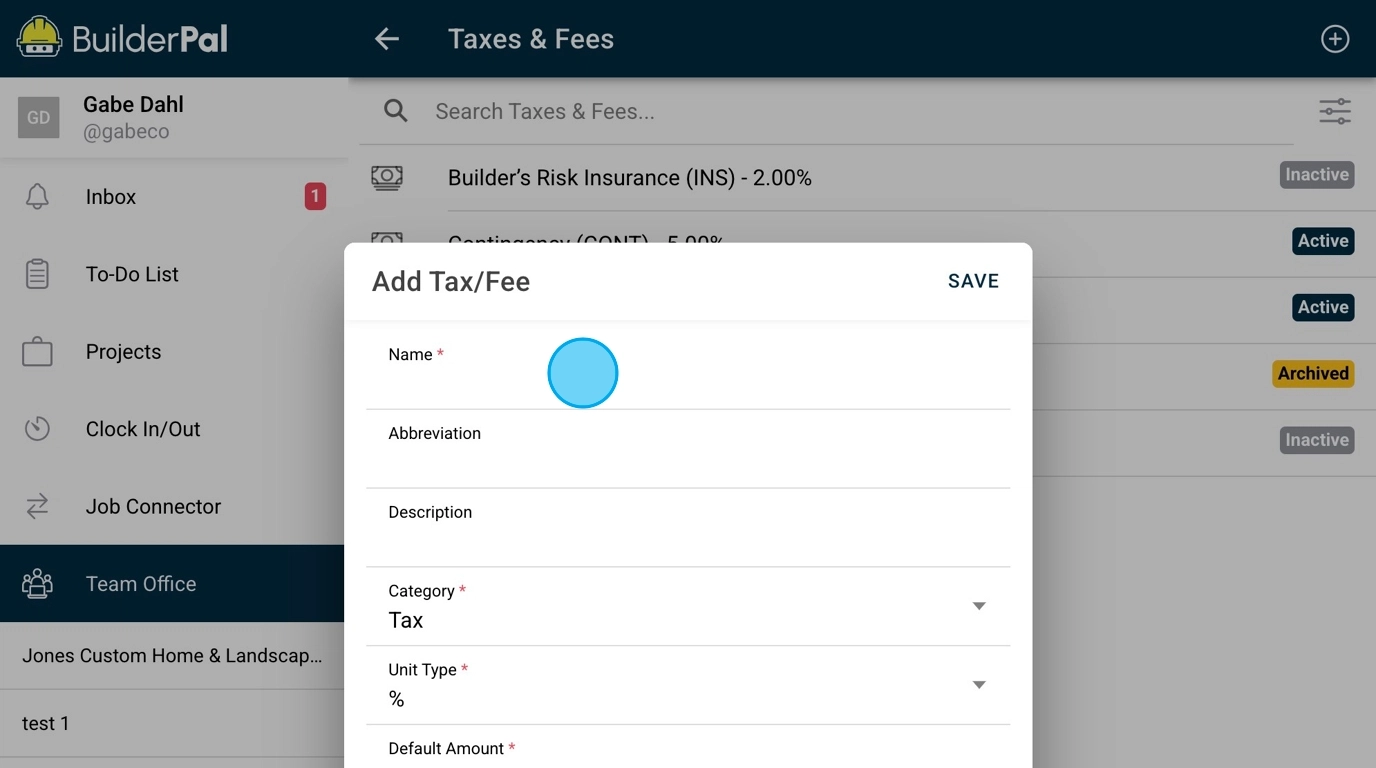

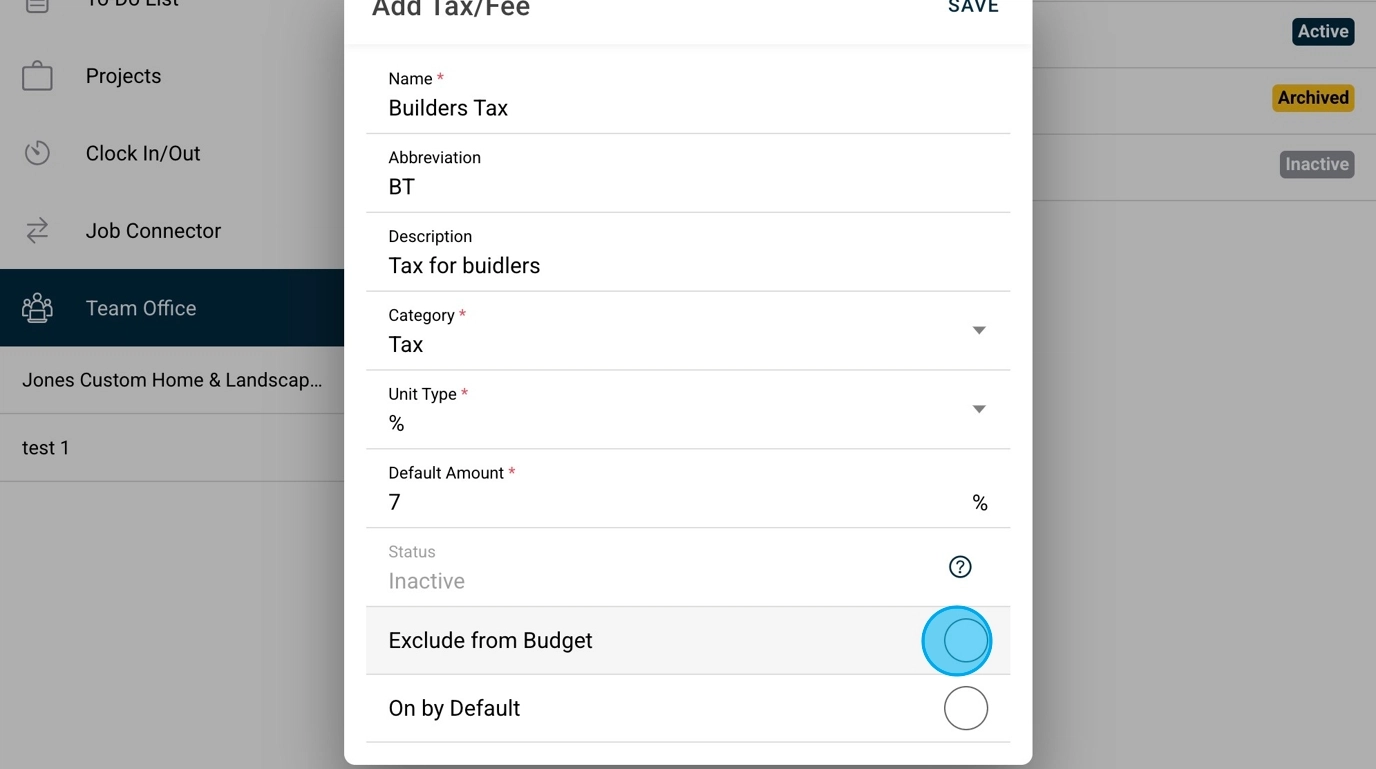

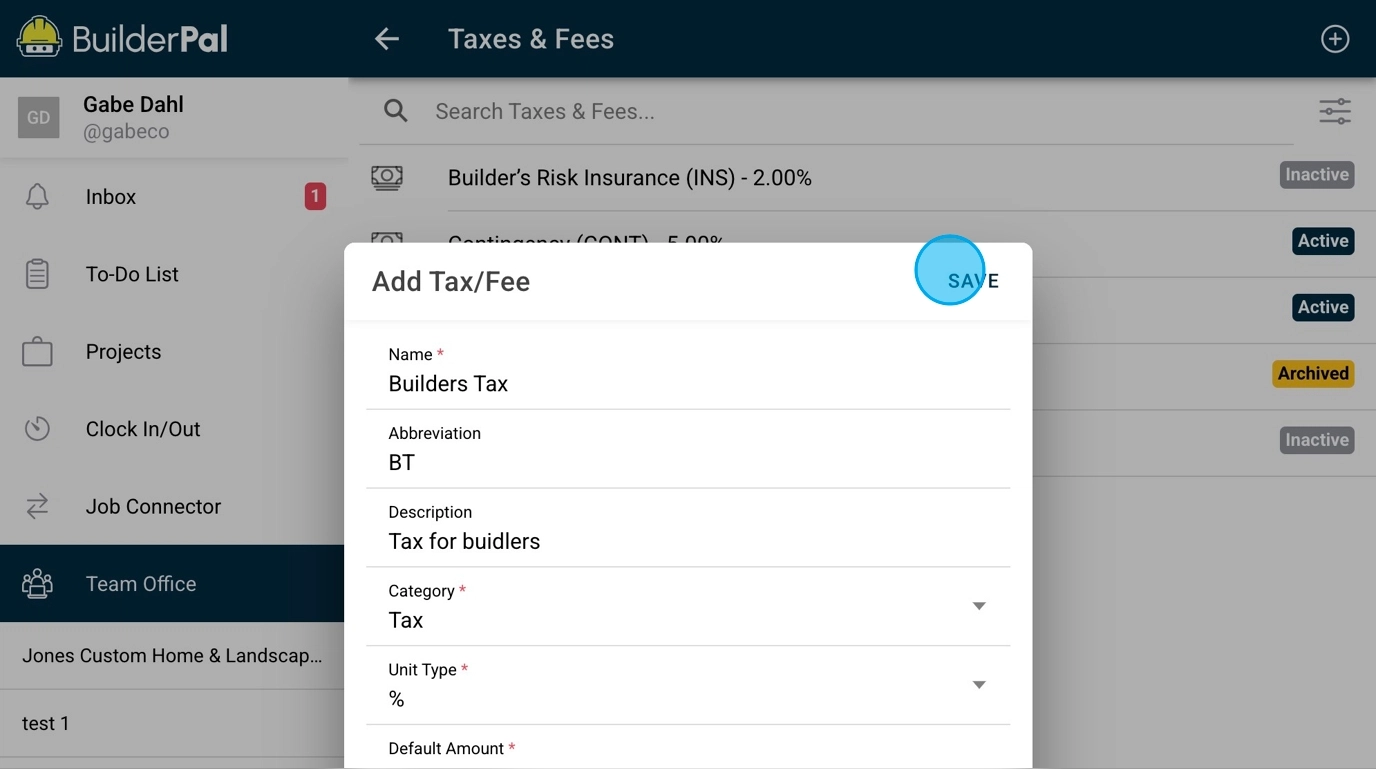

This tutorial guides you through adding and configuring taxes and fees in BuilderPal, ensuring accurate cost tracking and budgeting for your construction projects without affecting profitability calculations incorrectly.

Prerequisites

- You must have one of the following roles: Admin (GC), Admin (SUB), Admin (SHORTCUT), Team Project Manager, Team Finance Manager, or Team Business Manager.

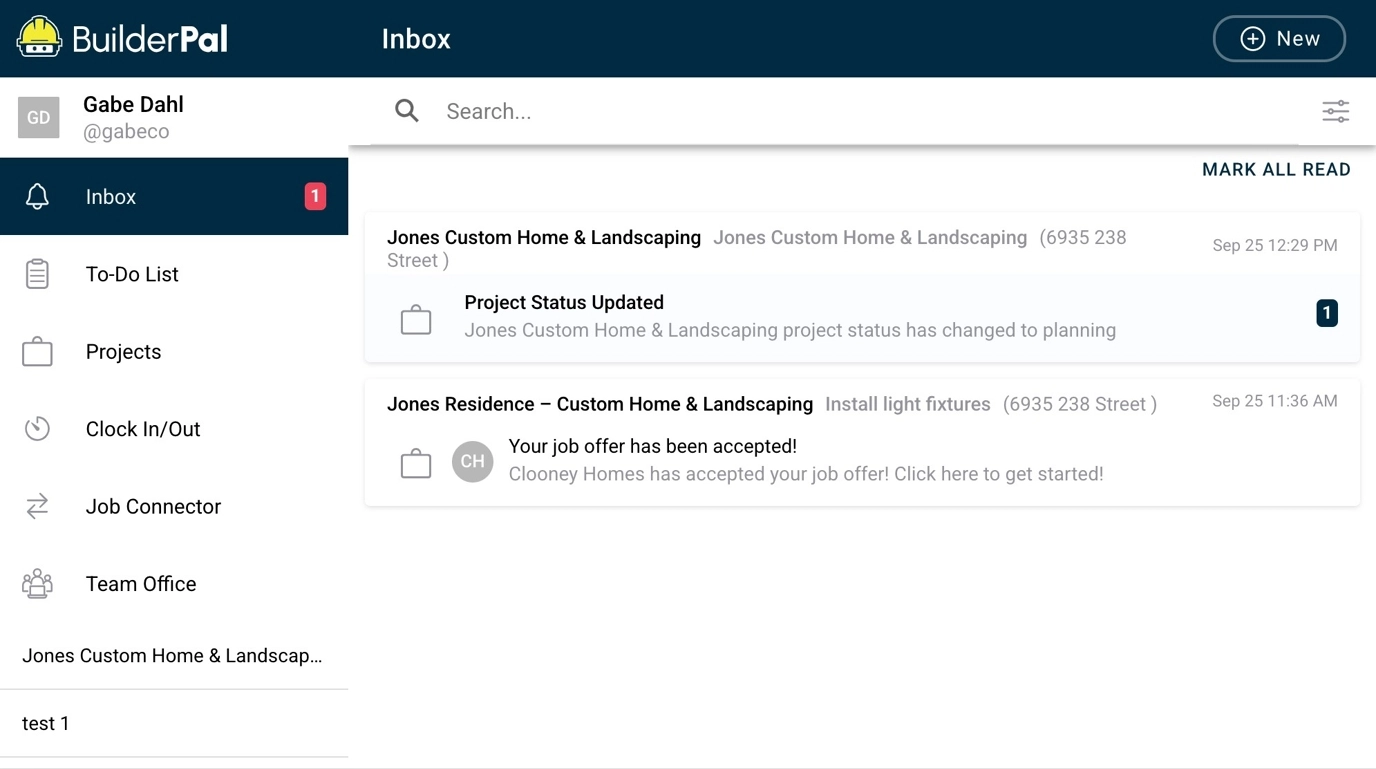

- Access to the Team Office in BuilderPal at https://app.builderpal.com.

Steps

Confirmation

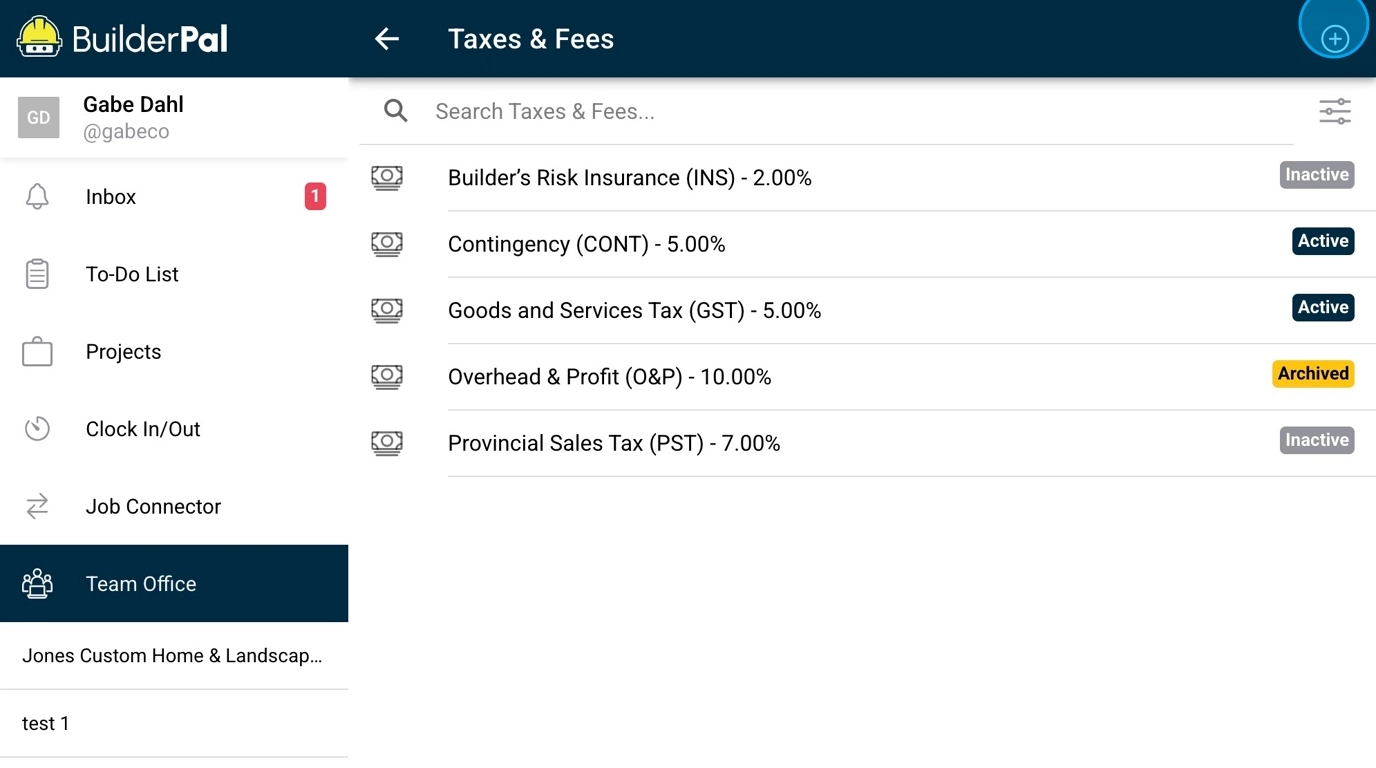

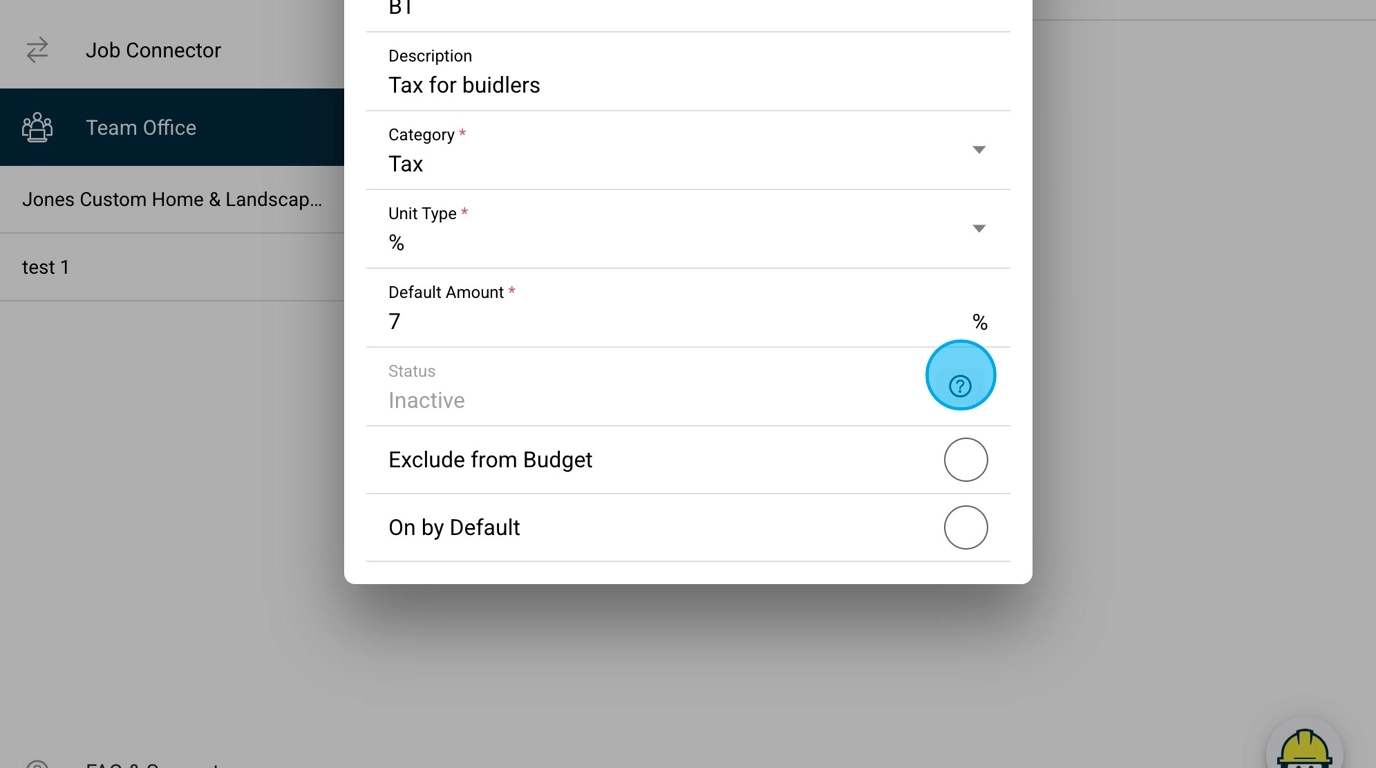

You’ll know it worked when the tax or fee appears in your list, changes to active upon use in a cost item, and applies correctly without impacting budgets if excluded.

FAQ

Q: Why is my tax or fee showing as inactive?

A: New taxes and fees start inactive and become active only after being used in at least one cost item.

Q: What happens if I archive a tax or fee?

A: Archived items cannot be applied to new cost items, but they remain on existing ones.

Q: How does "Exclude from Budget" affect my projects?

A: It treats the tax or fee as a pass-through cost, hiding it from budget calculations to avoid impacting profit margins.

Q: Can I edit a tax or fee after saving?

A: Yes, return to the Taxes & Fees page and click on the item to edit its details, but changes may not retroactively apply to existing cost items.

Q: What's the purpose of the abbreviation field?

A: The abbreviation provides a short code for quick reference in estimates, budgets, and reports.

Related Articles

- Manage Cost Codes

- Create a Budget

- Finance Center Overview

- Edit Project Budget

- Budget Report